Table of Contents

The popularity of cryptocurrencies has changed the financial world, leading to a growing need for crypto exchanges to buy and sell digital assets. Recent data shows that the global crypto exchange market was worth about $50 billion in 2023 and is expected to grow at 22% in five years. This fast growth reflects the huge potential while also revealing the challenges in terms of stiff competition.

Despite starting as a small crypto exchange in 2017, Binance quickly scaled to become one of the industry’s largest influential platforms. As of 2024, Binance boasts over 120 million registered users and handles daily trading volumes exceeding $1 billion. The rapid rise of Binance shows great promise, but the platform had to rise through many challenges as well to become a successful crypto exchange.

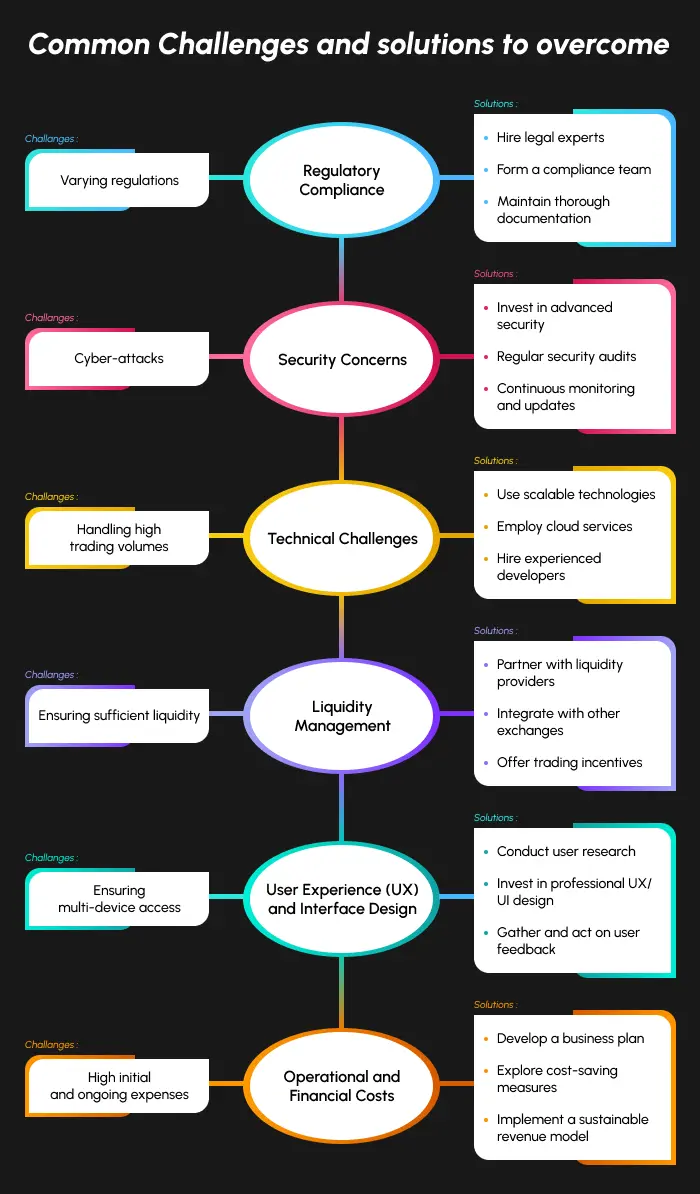

Startups in this field face many challenges, from dealing with complex regulations to ensuring their platform is secure. In this blog, let us discuss the common challenges in creating crypto exchange and how to overcome them. So, We’ll start with the…

Common Challenges in Creating Crypto Exchange

Developing a cryptocurrency exchange is a challenging endeavor. As the industry expands and develops, the challenges of building a platform also grow. Here are the key hurdles faced by startups when creating a crypto exchange.

1. Regulatory Compliance

Following cryptocurrency trading rules can be tricky because regulations vary widely. In the U.S., rules differ at federal, state, and local levels. In the EU, the new MiCA regulation aims to standardize rules across member countries, but individual nations might have their own rules. It’s particularly hard to follow Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements because they need thorough identity checks to stop illegal activities. If exchanges don’t follow these rules, they can get big penalties or even get shut down.

2. Security Concerns

Security is a critical concern for crypto exchanges due to the high risk of cyber-attacks targeting digital assets. Exchanges are frequently targeted by hackers who attempt various attacks, including phishing, hacking, and ransomware. Protecting user funds and data from these threats requires implementing sophisticated security measures. To learn more about the critical role of security in crypto exchanges, you can refer to our in-depth guide.

Cybersecurity breaches can lead to financial losses, compromise user information, and damage the platform’s reputation. As the crypto industry evolves, so do the tactics used by attackers, making it essential for exchanges to stay ahead of emerging threats and continually update their security protocols.

3. Technical Challenges

The technical aspects of creating and operating a crypto exchange involve significant challenges related to system design, scalability, and performance. The platform must be capable of handling high trading volumes while ensuring a seamless user experience. This includes managing real-time trading and processing large amounts of data efficiently. Technical issues such as system downtime or slow transaction processing can negatively impact user satisfaction and trading efficiency. Developing a robust system architecture that can scale with increased user activity and trading volume is essential but complex. Technical challenges also encompass database management, effective caching, and ensuring low latency, all of which require expert knowledge and ongoing optimization.

4. Liquidity Management

Managing liquidity is a crucial challenge for crypto exchanges. Sufficient liquidity is necessary to enable users to buy and sell assets at fair prices without causing significant market fluctuations. Low liquidity can lead to price volatility and a poor trading experience, as it may be harder for users to execute trades at desired prices.

Exchanges need to ensure there is enough liquidity to support smooth trading operations and maintain a stable market environment. This often involves balancing the availability of assets and engaging with liquidity providers, which can be complex and resource-intensive.

5. User Experience (UX) and Interface Design

Providing an excellent user experience (UX) and intuitive interface design is essential for attracting and retaining users on a crypto exchange. A platform with a complicated or poorly designed interface can frustrate users and make trading more challenging. Highlighting the features of a cryptocurrency exchange that enhance UX can significantly improve the overall user experience and attract more users.

Additionally, the platform must be accessible across various devices, including computers, tablets, and smartphones, to accommodate a diverse user base. A bad user experience can lead to dissatisfaction and lower engagement, ultimately affecting the overall success of the interaction.

6. Operational and Financial Costs

Developing a comprehensive crypto exchange business plan is critical to managing initial and ongoing costs effectively. By planning for expenses and identifying sustainable revenue models, such as trading fees or subscription plans, you can support the financial stability of your platform.

Compliance with government regulations adds another layer of cost, including legal fees and ongoing compliance checks. Daily operational expenses, such as customer support, marketing, and administrative tasks, also contribute to the overall financial burden. Managing these costs effectively is crucial for the long-term success and sustainability of the exchange, requiring careful financial planning and resource allocation.

Overall, creating a crypto exchange presents a range of complex challenges. Each of these aspects requires careful attention and strategic planning to ensure the platform’s success and sustainability.

As these challenges can be daunting, it’s crucial to explore effective solutions to overcome them.

Ideal Solutions to Overcome the Challenges

When starting a crypto exchange, you’ll need to handle a variety of challenges related to regulations, technology, and operations. To make sure your platform is successful, you need to focus on several key areas. Each of these factors is critical in ensuring that your exchange is stable, secure, and attractive.

Here are the best solutions to overcome the above-given challenges.

1. Following Regulations

To meet regulatory requirements, work with legal experts specializing in cryptocurrency and financial laws. Create a compliance team to ensure all your operations comply with current laws and keep thorough documentation for audits and regulatory changes.

2. Integrate Security Measures

Invest in advanced security technologies like multi-signature wallets, encryption, and regular security audits. Implement strong security protocols and continuously monitor for potential threats. Keep your systems updated and patched to address any vulnerabilities.

3. Technical Guidance

Use scalable and robust technologies to handle high transaction volumes. Consider utilizing cloud services for flexibility and performance optimization. Hire experienced developers to design a system architecture that supports efficient trading operations and effectively handles peak loads.

4. Managing Liquidity

Establish relationships with liquidity providers to ensure sufficient asset availability. Integrate with other exchanges to improve liquidity through partnerships and data sharing, enabling seamless access to multiple liquidity pools. Offer trading incentives such as fee rebates, liquidity mining programs, and exclusive tools to attract market makers and enhance overall liquidity on your platform.

5. Better User Experience and Interface Design

Conduct user research to understand the needs and preferences of your target audience. Invest in professional UX/UI design to create an intuitive and appealing interface. Continuously gather user feedback and make improvements to enhance the overall trading experience.

6. Operations and Finances

Develop a detailed business plan to manage initial and ongoing costs effectively. Explore cost-saving measures like cloud computing and outsourcing non-core functions. Make sure you have a sustainable revenue model, such as trading fees or subscription plans, to support operational expenses.

By implementing strategic solutions, you can effectively navigate these complexities and build a robust and attractive platform.

With these solutions in place, it’s essential to focus on the major considerations that can further influence the success of your crypto exchange. In the next section, we will explore the key factors and decisions that play a pivotal role in shaping a successful crypto exchange, offering valuable insights to guide your platform’s development and strategic planning.

Major Considerations While Creating Crypto Exchange

Creating a successful crypto exchange involves careful attention to several critical factors.

- Conducting in-depth market research and demand analysis is essential for tailoring your exchange to meet user needs and attract a solid user base.

- Selecting the right technology stack and infrastructure is crucial for ensuring high performance, scalability, and platform stability.

- Addressing compliance and risk management is equally important; establishing strong practices in these areas helps mitigate legal and financial risks, ensuring your exchange remains viable and secure in a constantly evolving regulatory environment.

Final thoughts

Building a cryptocurrency exchange comes with its share of technical and regulatory challenges. Successfully navigating these complexities requires the right expertise. Partnering with a specialized Crypto exchange development company can make a significant difference, ensuring seamless integration of both technology and compliance. With the right team by your side, you can build a secure, scalable, and legally compliant exchange that stands out in the market.

We at Pixel Web Solutions provide insights about the latest industry trends and technologies, ensure that your platform adheres to legal requirements, and implement robust risk management strategies. Our experience with crypto exchange development services can streamline the development process, helping to overcome challenges and setting the stage for a successful launch and ongoing operation of your crypto exchange.