Table of Contents

“Cryptocurrencies total market capitalization surpassing $2 trillion in early 2024” – CoinMarketCap

Yes, it is true.

Cryptocurrency has transformed from a niche investment opportunity to a global financial phenomenon. Today, the crypto industry offers countless entrepreneurial opportunities. If you’re looking for a way to tap into this thriving market, the possibilities are almost endless. Here, we’ll explore some of the best cryptocurrency business ideas, discuss why it’s a great time to enter the crypto market, and offer insights on how to choose the right venture.

Why Start a Cryptocurrency Business Now?

Cryptocurrency is no longer just about Bitcoin; it’s a growing ecosystem with blockchain, decentralized finance (DeFi), non-fungible tokens (NFTs), and digital payment solutions. Here’s why entrepreneurs are considering a crypto-based business:

- High Growth Potential: With digital assets growing in adoption, there’s significant profit potential.

- Global Reach: Crypto eliminates geographical barriers, enabling worldwide access.

- Innovation-Driven Market: Blockchain technology promotes innovation in finance, art, gaming, and more.

- Diverse Revenue Streams: Crypto-based businesses can generate revenue through trading fees, subscription models, asset minting, and more.

- Early Mover Advantage: The industry is still evolving, offering new entrants an advantage in carving out unique niches.

Without any delay, we’ll see the…

Top 10 Cryptocurrency Business Ideas to Explore in 2025

- Start a Crypto Exchange Platform

- Create a DeFi platform

- Choose Blockchain Consulting

- Develop an NFT Marketplace

- Launch a Crypto Payment Gateway

- Create Your Own Crypto Token

- Develop a Crypto Wallet

- Start a Crypto Crowdfunding Platform

- Create a Crypto Gaming Platform

- Launch a Crypto ATM

1. Starting a Cryptocurrency Exchange

Starting a Crypto Exchange Platform requires advanced knowledge of blockchain technology, finance, and cybersecurity. This type of platform is essential for trading cryptocurrencies and benefits from high market potential and increasing user adoption. As startups look to enter the crypto space, creating a Crypto Exchange Platform can offer significant revenue opportunities.

In 2023, the global cryptocurrency exchange market was valued at approximately $1.5 billion and is projected to expand at a compound annual growth rate (CAGR) of 15.3% from 2024 to 2030.

Business Opportunities

1. Spot Trading – Providing a platform for users to trade cryptocurrencies at current market prices.

2. Margin and Futures Trading – Offering leverage and futures contracts for more advanced trading strategies.

3. Staking and Yield Farming – Allowing users to earn interest by staking their crypto assets or participating in yield farming.

Revenue Model

- Transaction Fees

- Withdrawal Fees

- Listing Fees.

Key Players

Binance – Major exchange with a wide range of cryptocurrencies, advanced trading features, and staking.

Coinbase – known for user-friendliness and regulatory compliance, ideal for buying, selling, and storing cryptocurrencies.

If you’re serious about starting an exchange, our detailed guide on How to Create a Crypto Exchange walks you through every crucial step.

2. Creating a DeFi Platform

Creating DeFi (Decentralized Finance) Platforms and dApps needs expertise in blockchain development and smart contracts. The rapid expansion of DeFi highlights its significant potential for innovation and high returns. These platforms aim to offer financial services without intermediaries, creating opportunities for startups to tap into a burgeoning sector.

In 2023, the Decentralized Finance (DeFi) sector surpassed $40 billion in total value locked (TVL), highlighting substantial growth and user interest.

Business Opportunities

1. Lending/Borrowing Platforms – Develop platforms that enable users to lend their assets and earn interest or borrow against collateral.

2. Decentralized Exchanges (DEXs) – Creating platforms for trading cryptocurrencies without a central authority.

3. Yield Aggregators – Tools that maximize returns by moving assets between different DeFi protocols.

Revenue Model

- Transaction Fees

- Interest Rate Spread

- Protocol Fees

Key Players

Uniswap – Decentralized exchange for swapping ERC-20 tokens using an automated market maker model.

Aave – Decentralized lending protocol for borrowing and lending with collateral and interest rate algorithms.

3. Blockchain Consulting Services

Blockchain Consulting involves skills in blockchain technology and business strategy. With more businesses exploring blockchain applications, there is a strong need for consultants who can help implement and optimize these solutions. Startups entering this field will find a niche market where their expertise can guide companies through the complexities of blockchain integration and strategy.

The global blockchain technology market, including consulting services, is projected to reach $68 billion by 2027, driven by a compound annual growth rate (CAGR) of 68.4% from 2023.

Business Opportunities

1. Strategy Development – Helping businesses identify how blockchain can be integrated into their operations or used to create new products.

2. Technical Integration – Assisting with the integration of blockchain technology into existing systems and workflows.

3. Regulatory Compliance – Advising on compliance with legal and regulatory requirements related to blockchain technology.

Revenue Model

- Consulting Fees

- Implementation Fees

- Ongoing Support

Key Players

ConsenSys – Blockchain consulting focused on Ethereum.

ChainSafe Systems – Specialized in blockchain development and integration services.

Also Read: Blockchain Business Ideas You Can Start Right Away

4. Develop an NFT Marketplace

Launching an NFT Marketplace demands experience in e-commerce, blockchain technology, and digital art. The NFT market’s rapid expansion presents a lucrative opportunity to create platforms where digital assets like art, music, virtual real estate, and collectibles can be traded. Startups can capitalize on this growth by building marketplaces for buying and selling digital art and collectibles.

In 2021, the NFT market saw transactions exceeding $24 billion, with strong interest continuing into 2024.

Business Opportunities

1. Curated Collections – Launching exclusive or themed collections of NFTs to attract buyers and collectors.

2. Auction Systems – Implementing auction mechanisms for high-value or rare NFTs to maximize sales.

3. Artist Partnerships – Collaborating with artists to create and promote exclusive NFT drops.

Revenue Model

- Transaction Fees

- Listing Fees

- Creator Royalties

Key Players

OpenSea – Leading NFT marketplace for digital art, collectibles, and virtual real estate.

Rarible – Decentralized NFT marketplace with a governance token for community voting.

Also Read: Step-by-step Guide to create an NFT Marketplace

5. Launch a Crypto Payment Gateway

Starting a Crypto Payment Gateway requires knowledge of payment systems and financial technology. As more businesses and consumers seek to use cryptocurrencies for transactions, integrating crypto payment solutions becomes crucial. Startups in this area can help facilitate cryptocurrency adoption and cater to a growing market.

The global crypto payments market is projected to grow at a compound annual growth rate (CAGR) of 30.3% from 2024 to 2030, reaching $8 billion.

Business Opportunities

1. Merchant Services – Providing payment processing services to businesses of all sizes.

2. Payment Gateway Integration – Integrating cryptocurrency payment options into online stores and apps.

3. Wallet Solutions – Developing or offering wallets specifically designed for handling crypto payments.

Revenue Model

- Transaction Fees

- Subscription Fees

- Conversion Fees

Key Players

BitPay – Payment processor for accepting and managing cryptocurrency payments.

CoinGate – Payment solutions provider for e-commerce and physical retail locations.

Also Read: How to create crypto payment gateway

6. Create Your Own Crypto Token

Creating a Crypto Token needs skills in blockchain development and tokenomics. The demand for new tokens is driven by innovative use cases and community support. Developing a custom token allows startups to tailor it to specific business needs and potentially raise capital through token sales or ICOs.

Currently, there are over 20,000 different crypto tokens across various platforms, with new tokens frequently emerging.

Business Opportunities

1. Initial Coin Offerings (ICOs) – Launching a token to raise funds for a new project or startup.

2. Tokenization of Assets – Creating tokens that represent ownership of physical assets like real estate or commodities.

3. Loyalty Programs – Developing tokens for customer loyalty programs, allowing users to earn and redeem rewards.

Revenue Model

- Token Sales

- Transaction Fees

- Utility Payments

Key Players

Uniswap’s UNI token – Governance token for voting on Uniswap protocol changes.

Chainlink’s LINK token – Used to pay for off-chain data services within the Chainlink network.

Also Read Our Recent Blog: How To Create A Crypto Token: 9 Essential Steps Explained

7. Starting a Crypto Wallet Business

Developing a Crypto Wallet requires expertise in software development and cybersecurity. The high demand for secure and user-friendly wallet solutions makes this a promising business area. Startups can address the need for secure storage of digital assets by creating effective wallet solutions.

The global digital wallet market is projected to grow to $12.4 billion by 2028, driven by a compound annual growth rate (CAGR) of 27.8%.

Business Opportunities

1. Wallet Development – Creating crypto wallets with enhanced features and security.

2. Security Solutions – Offering additional security features such as multi-signature authentication and biometric access.

3. Cross-Platform Integration – Ensuring compatibility with various operating systems and blockchains.

Revenue Model

- Sales of Hardware Wallets

- Premium Features

- Transaction Fees

Key Players

MetaMask – Browser extension wallet supporting Ethereum-based tokens; provides dApp access.

Ledger – Hardware wallet for secure offline storage of private keys.

Also Read: How To Create Crypto Wallet?

8. Start a Crypto Crowdfunding Platform

Starting a Crowdfunding Platform involves knowledge of financial technology and fundraising. The growing interest in alternative funding sources is creating opportunities for blockchain-based crowdfunding solutions. Startups can provide a modern way for projects to raise capital, offering an alternative to traditional venture capital.

In 2023, the global crowdfunding market was valued at approximately $13.8 billion and is expected to grow significantly.

Business Opportunities

1. Token Launchpads – Platforms for launching new tokens and raising capital through Initial DEX Offerings (IDOs) or similar mechanisms.

2. Equity Crowdfunding – Enabling investment in startups through tokenized equity or convertible tokens.

3. Reward-Based Crowdfunding – Offering rewards or incentives paid in cryptocurrency for supporting projects.

Revenue Model

- Launchpad Access Fee

- Investor Fees

- Token Listing Fee

Key Players

Kickstarter – Traditional crowdfunding platform.

Polkastarter – Crypto-focused token sale and fundraising platform.

SeedInvest – Equity crowdfunding platform with blockchain integration for tokenized investments.

9. Create a Crypto Gaming Platform

Creating a Crypto Gaming Platform involves expertise in blockchain technology, game development, and digital asset management. This sector offers substantial market potential due to the rising adoption of decentralized gaming and the growing demand for play-to-earn models.

In 2023, the market was valued at approximately $2 billion and is projected to grow by 18.2% annually through 2030.

Business Opportunities

1. Play-to-earn (P2E) Games – Develop games where players can earn cryptocurrency or NFTs through gameplay, which can be traded or sold on the platform.

2. In-Game Asset Marketplace – Providing a marketplace for players to buy, sell, or trade in-game assets, such as NFTs or virtual items, using cryptocurrency.

3. Staking and Governance – Allowing players to stake native tokens to earn rewards or participate in the governance of the gaming ecosystem.

4. Tokenization of Game Assets – Enabling players to own, trade, and invest in unique digital assets that represent in-game items, characters, or properties.

Revenue Model

- In-game purchases

- Listing Fees for NFTs

- Subscription Models

Key Players

1. Axie Infinity – A leading play-to-earn game that allows players to earn cryptocurrency through battles, breeding, and trading Axies, which are NFTs.

2. The Sandbox – A virtual world where players can create, own, and monetize their gaming experiences and assets, supported by a robust blockchain infrastructure and a thriving marketplace.

3. Decentraland – A decentralized virtual reality platform where users can buy, sell, and build on virtual land using cryptocurrency, with a focus on social and gaming experiences.

10. Launch a Crypto ATM

Launching a Crypto ATM demands expertise in hardware development and logistics. These machines offer a convenient way for users to buy and sell cryptocurrencies, reflecting the growing consumer demand for accessible digital asset transactions. Startups in this space can capitalize on the rapid expansion of ATM installations to meet the needs of users seeking easy cryptocurrency transactions.

As of 2024, the number of Bitcoin ATMs worldwide has surpassed 40,000, marking a significant increase from just over 6,000 in 2020.

Business Opportunities

1. Machine Placement – Placing ATMs in high-traffic areas like malls, airports, or convenience stores to attract users.

2. Transaction Fees – Earning fees from each transaction conducted through the ATM.

3. ATM Maintenance – Offering ongoing maintenance and support services for ATM operators.

Revenue Model

- Transaction Fees

- Rental Fees

- Exchange Margins.

Key Players

Bitcoin Depot – Bitcoin ATMs for buying and selling cryptocurrencies.

Coinme – Bitcoin ATMs with retail location collaborations for enhanced accessibility.

Overall, we have seen the top 10 cryptocurrency startup ideas that are ruling the current crypto world. Each of these business ideas taps into different aspects of the cryptocurrency ecosystem, offering various ways to generate revenue and provide value to users.

But you may have a doubt…

Which Cryptocurrency Business Idea is best for you?

Selecting the right cryptocurrency business depends on your expertise, budget, and risk tolerance. If you have strong technical knowledge, creating a DeFi platform or crypto exchange could be ideal. For a more passive venture, consider a crypto ATM or a consulting service that leverages existing expertise.

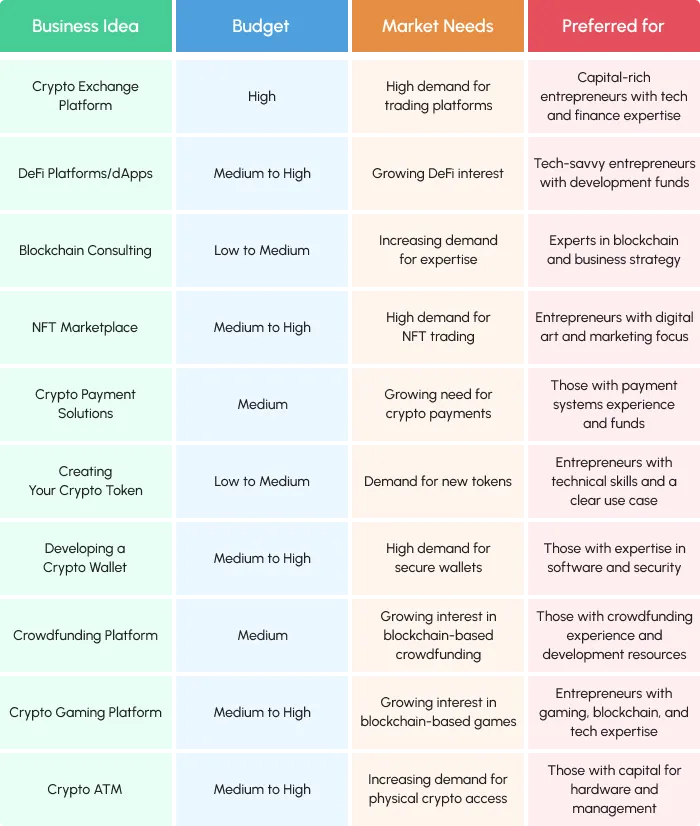

Analyzing yourself and identifying your skill set to handle a crypto business, the budget that you can able to afford, and market demand will help you find the best crypto business idea. Secondly, research the revenue you can earn and the rate of competition before making a decision. Totally, it is based on your business requirements and potential to start a new business and integrate crypto app ideas in the highly competitive market. To help you with this here is a detailed analysis.

From this tabular column, you can identify your potential to start a crypto-related business idea. Once you have concluded your crypto business idea, you need to know the…

Common Challenges in Starting a Cryptocurrency Business

Starting a crypto-related business can be both exciting and daunting. Here are four major challenges you might face:

- Regulations – Follow changing local rules on anti-money laundering (AML), know-your-customer (KYC), and data protection.

- Security – Use strong security measures to safeguard your infrastructure, smart contracts, and wallets.

- Market Volatility – Be prepared for drastic price changes that can affect finances and investor confidence

- Technology and Integration: – Ensure that your crypto-related software is scalable, reliable, and easy to use.

To overcome these challenges, seeking help from a professional crypto software development company can provide important expertise in following the rules, keeping things secure, managing market risk, and developing advanced technology, all of which can help make your business successful. When it comes to professionals, then…

Start Your Crypto Business with Pixel Web Solutions

Kickstart your crypto business with Pixel Web Solutions, a reputable cryptocurrency exchange development company in the blockchain sector, to streamline your entry into the world of digital currencies. We offer user-friendly software and top-notch security to help you succeed.

Whether you’re a seasoned investor or just starting, we offer the support and resources to navigate the complexities of the crypto market confidently. Embrace the future of your business with Pixel Web Solutions and turn your crypto business ideas into reality.

FAQ

Can I start a crypto business without technical knowledge?

Yes, certain crypto businesses like consulting or crypto ATMs require less technical knowledge. However, ventures like DeFi platforms or exchanges will need a technical partner.

Which crypto business idea has the lowest risk?

Consulting and crypto ATMs generally carry lower risks compared to other ventures, as they don’t require extensive technical infrastructure.

What are the best countries to start a crypto business?

Switzerland, Singapore, and Malta are known for favorable crypto regulations, but the U.S. and Canada are also strong contenders for crypto-friendly business environments.

How can I market my crypto business idea effectively?

Social media, influencer partnerships, and crypto forums are effective for marketing in the crypto space. Ensuring transparency and security is also essential for building a reputable brand.