Table of Contents

As per the reports of Skyquest, the global cryptocurrency exchange market capitalization was valued at USD 4.06 billion in 2022, and it is poised to grow to USD 11.7 billion in 2031. At this rate, it’s common for startups to have plans on building an exchange. However, one significant factor to succeed on that basis is deciding on the type. Innovating your crypto exchange platform with the right type will turn your business idea into a crypto market changer. Knowing about the types not only upgrades your creation plan but also increases your success rate. For a deeper understanding, explore Everything About Cryptocurrency Exchanges to learn how these different types function and which might suit your business best.

OK, This blog is a comprehensive guide on the types of cryptocurrency exchanges. Before we delve into it, let’s start with the basics.

Cryptocurrency Exchange – An Overview

Crypto exchanges are established trading platforms where users can buy, sell, stake, list, trade, and complete all crypto purposes with end-to-end security. They have revolutionized the traditional finance system by leveraging blockchain technology for higher security of assets. Hence, users can trade and make profits by capitalizing on the price volatility of Cryptos through these exchanges.

Without any thoughts, let’s have a detailed look at the various types of crypto exchanges.

What Are The 3 Main Types Of Cryptocurrency Exchanges?

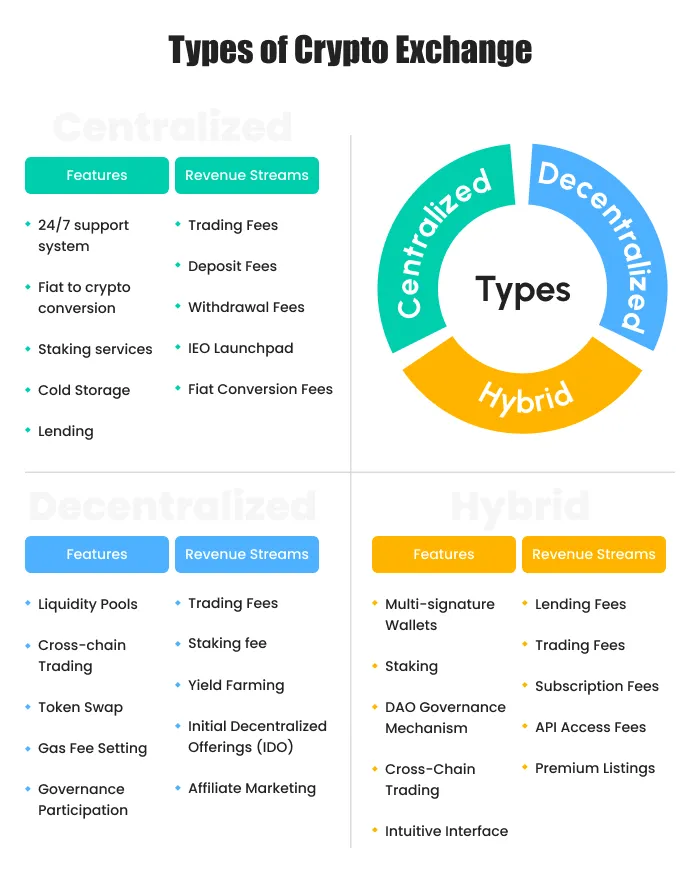

The crypto exchanges are differentiated depending on the working nature, central authority, wallet access, etc. The three major types of crypto exchanges are,

- Centralized Exchanges or CEX

- Decentralized Exchanges or DEX

- Hybrid Exchanges or HEX

Centralized Crypto Exchange (CEX)

Centralized crypto exchanges are platforms where users trade crypto assets like Bitcoin under the monitoring of a central authority. These platforms have numerous trading features and tools, and the transactions are stored in a centralized server. The Users have to pay certain fees for every successful transaction. For any user problem that arises in the exchange, the admin takes responsibility.

In centralized exchanges, users have to complete KYC or Know Your Customer for identity verification before they trade.

The centralized crypto exchanges are subdivided into three categories,

- Peer-to-peer Order Book based

The order book comprises a list of buy(bids) and sell(ask) orders of crypto assets for security purposes. An orderbook-based exchange presents users with the simplest and quickest way to trade. The order book is enhanced by two features, a trading chart, and trading pairs to help the user make a decision spontaneously. The matching engine is an integral part of order books as it helps a buy order and a sell order to be matched at a compatible price with higher efficiency.

The orders can be categorized into four types of cryptocurrency exchanges, market order, limit order, trailing stop order, stop limit order, etc. Each order has its own purpose and is significant to buy or sell Cryptos in these exchanges.

Market Order

Market Order allows users to buy or sell Cryptocurrencies at the best current market price. This option is helpful for emergency or instant trading without second thoughts about the price changes. For example, if a user is happy with the current price of Bitcoin and wants to sell it instantly, market order is the best choice.

Limit Order

Limit Order allows users to set a price range for Cryptos. Whenever the Crypto comes under the price range, a buy or sell order gets executed based on the profit level. For example, if a user has bought for a price of $100, and set the range to $110, a sell order gets executed when the price goes to $110 or above. On the other hand, if the Crypto price is bought for $100, and the price is likely to reduce tomorrow, you can set a range up to $90. When the price reaches $90, a buy order is filled immediately.

Stop Limit Order

Stop limit orders enable crypto users to set their desired minimum and maximum price for the trade. This will help your users reduce their huge loss rate in crypto trading. For instance, with the stop limit order, if the current price of the Crypto is $40,000. The user has set a stop price of $45,500 and a limit price of $45,000, the order will be executed at the minimum price of $45,000 or more.

Trailing Stop Order

Trailing stop is an enhanced technique where users can set a pre-set order at a desired price away from the market price. This helps users in an unfavorable condition of the market price and to manage your user’s profit position automatically.

- Peer-To-Peer Ads based

Peer-to-peer or Ads-based crypto exchange allows users to communicate directly with each other but still come under a central authority. Here, the buy or sell order is listed through advertisements. The advertisement consists of the Crypto price, availability, expected price limit, and the payment mode required. KYC isn’t mandatory for all and depends on the particular advertiser.

The transaction process is secured through an escrow system. This escrow wallet acts as a temporary place for storing assets and once the payment process is completed, the assets are transferred from the escrow system to the trader’s wallet. The Peer-to-peer crypto exchange offers enhanced security for its users along with the option to negotiate directly between two traders.

- OTC Crypto Exchange

OTC or Over-the-Counter crypto exchange helps experienced traders buy cryptocurrencies in a bulk manner. In the other two types of centralized exchange platforms, users cannot trade crypto assets in large quantities due to various restrictions.

Also called User-to-admin exchange, the OTC exchange allows users to negotiate directly with the admin. Crypto whales who look for heavy investment in crypto prefer this type as it allows them to negotiate on the final price. These users can set up a long-term plan with the admin for constant Crypto trading and adequately adjust the prices too.

Also Read: Centralized Vs Decentralized Crypto Exchange – Detailed comparison

Decentralized Exchange (DEX)

Decentralized exchanges allow users to trade without an intermediary in between and no central authority is required to approve or control the crypto transactions. Users own complete access to their accounts, and crypto assets without any third-party’s interference. Hence, decentralized crypto exchanges offer their users a secure, transparent, and autonomous trading experience. Instead of a matching engine, decentralized exchanges rely on smart contracts for trading. These Smart Contracts have predefined terms and conditions which when met, facilitate a trade taking place.

Crypto users can swap, stake, and lend crypto tokens in the Dex platform. The advantage of utilizing a decentralized exchange is users can enjoy affordable transaction fees, higher transaction speed, and end-to-end privacy due to its decentralized nature. The decentralized exchanges are divided into three major sub-divisions,

- DEX Order Book

DEX order book is quite similar to the order book in centralized exchanges, the major difference being smart contracts. The trading pairs, price chart, and buy and sell order information are all provided on the platform. Users can connect their preferred wallet to the platform without having to verify and can start trading. The transactions between two traders are directly stored on the blockchain ledger.

- AMM based DEX

AMM or Automated market maker-based DEX platform uses pre-defined algorithms and smart contracts to facilitate trading (swapping). Unlike traditional order books, the AMM-based market utilizes liquidity pools and allows users to swap Cryptocurrencies. Users earn passive income and rewards for providing liquidity to the platform. The token prices are determined by a ‘constant product formula’ to make the liquidity pool constant.

- DEX Aggregator

The DEX aggregator offers users multiple decentralized exchange liquidity and crypto asset prices. These platforms help users find an optimal trading option, especially pricing and liquidity. information from various sources is collected and offered to the crypto users for an innovative trading environment. These platforms allow users to trade or swap cryptocurrencies at a lower slippage rate, lower transaction fees, and an optimized trading experience.

Also Read: How To Build A Decentralized Exchange? A Guide For Beginners

Hybrid Crypto Exchange (HEX)

The hybrid crypto exchange comprises both the features of centralized and decentralized crypto exchanges. They are designed for crypto users who want to utilize both the functionalities and benefits of centralized and decentralized exchanges. For instance, a user who wants higher security protocols to protect the crypto assets and also high-speed trading pairs can choose hybrid exchanges.

In simple terms, hybrid exchanges provide users with speed, efficiency, liquidity, fiat-to-crDifferent Types of Crypto Exchanges You Need To Knowypto conversions, etc of the centralized exchange alongside the security, privacy, and self-custody of decentralized exchanges. The hybrid exchanges possess the centralized exchange’s order-matching engine which facilitates high-speed trading experience. Also, it is designed with DeFi smart contracts that offer secure and transparent trading.

Hence, these are the major three types of crypto exchanges and their sub-divisions. Each type of crypto exchange has unique features and offers various ways to generate revenue. Learn more about different Crypto Exchange Revenue Streams to understand the potential business opportunities.

CEX vs DEX vs HEX – Which is Best?

For simple understanding, we have provided a table illustration that mentions the differences between the major three types of crypto exchanges.

These are common differences between centralized, decentralized, and hybrid crypto exchanges. Aside from these, there are a lot of technical differences that make them stay apart. Deciding on one type depends on your requirements and requires strategic analysis of its features as well.

Also Read: Top 10 Must-Have Features Of A Cryptocurrency Exchange

Conclusion

We hope this guide has provided you with a clear understanding of the different types of crypto exchanges. Knowing these distinctions lays the groundwork for a strong exchange business strategy.

Creating a crypto exchange is no longer a daunting task when you have Pixel Web Solutions by your side. With our expertise in cryptocurrency exchange platform development, we craft tailored, robust trading platforms designed to help startups succeed. Our experienced development team ensures precision, security, and scalability while guiding you through every step of the process.

Kickstart your dream crypto exchange business with our expert team today!